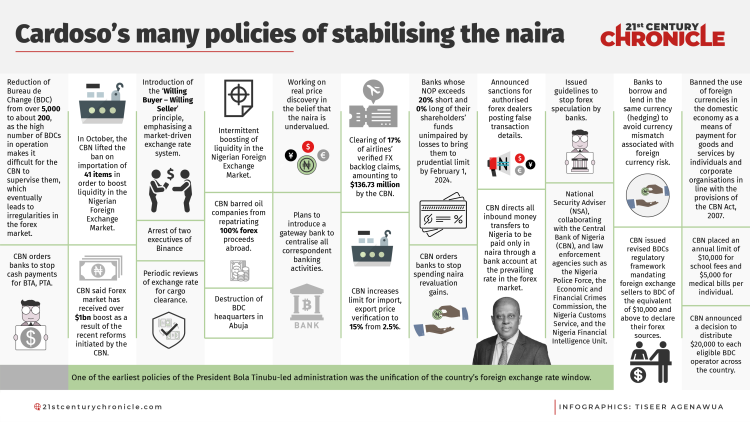

One of the earliest policies of the President Bola Tinubu-led administration was the unification of the country’s foreign exchange rate window.

President Tinubu in justification of the policy said hecould have chosen to keep the previously multiple foreign exchange system and benefit from it, but he decided to unify the official and parallel market rates to save the country from financial haemorrhage.

Closely on the heels of that, a new governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso was appointed in September 2023.

Upon his appointment, one of the issues the CBN governor was confronted with was the issue of the naira depreciation.

To address this, the Cardoso-led CBN leadership churned out policy after policy, all aimed at restoring the value of the naira.

Shortly after his appointment, Cardoso, while speaking at the National Economic Summit in Abuja, said the bank will publish a robust policy documentation on what the rules of the foreign exchange market operation would be in the coming weeks.

“We will come out with something that is representative of the true market because the market will adjust to some of these things over time,” Cardoso stated.

He also outlined the policy direction of the CBN for 2024, with a pledge to prioritise price and exchange rate stability to promote sustainable economic growth, safeguarding the livelihoods of Nigerians.

In the beginning, it seemed the policies were not yielding the desired result as the value of the naira continued to depreciate, with the economy taking a hit for it.

In December 2023, the exchange rate was N907.1/$1. The CBN even warned speculators against hoarding the dollar, saying the figures will go even lower. However, by the end of January, the naira had been devalued to about N1,455.59 – a 37.7 per cent depreciation in one month.

The value of the naira further depreciated, trading at an all-time low of N1915/$ at the parallel market as at the end of February 2024.

Sustained security onslaught at the BDC market in addition to other policies brought the exchange rate at the parallel market to between N1,600 – N1,650 to a dollar, a figure that was still considered high.

However, by the end of March, the naira regained some strength and settled at N1,255/$ at the parallel market.

As at Thursday April 4, 2024, the naira traded at N1,255.07/$ at the official market.

This indicates a gain of about N660 against the dollar in about 5 weeks.

Some of the forex saving policies, based on content analysis of news reports include:

1. A call for reduction of the number of Bureau de Change (BDC) in the country from over 5,000 to about 200, as the high number of BDCs in operation makes it difficult for the CBN to supervise them, which eventually leads to irregularities in the forex market.

2. In October, the CBN lifted the ban on importation of 41 items banned by the previous CBN governor, Godwin Emefiele, saying the ban would The central bank said it will also boost liquidity in the Nigerian Foreign Exchange Market and intervene from time to time, stating that interventions will decrease as liquidity improves.

3. Introduction of the ‘Willing Buyer – Willing Seller’ principle, emphasising a market-driven exchange rate system.

4. Intermittent boosting of liquidity in the Nigerian Foreign Exchange Market.

5. Working on real price discovery in the belief that the naira is undervalued.

6. Clearing of 17% of airlines’ verified FX backlog claims, amounting to $136.73 million by the CBN.

7. Issued guidelines to stop forex speculation by banks.

8. Announced sanctions for authorised forex dealers posting false transaction details.

9. Banks whose NOP exceeds 20% short and 0% long of their shareholders’ funds unimpaired by losses to bring them to prudential limit by February 1, 2024.

10. Banks to borrow and lend in the same currency (hedging) to avoid currency mismatch associated with foreign currency risk.

11. To enforce ban on use of foreign currencies in the domestic economy as a means of payment for goods and services by individuals and corporate organisations in line with the provisions of the CBN Act, 2007.

12. Plans to introduce a gateway bank to centralise all correspondent banking activities.

13. CBN said Forex market has received over $1bn boost as a result of the recent reforms initiated by the CBN.

14. Periodic reviews of exchange rate for cargo clearance.

15. CBN barred oil companies from repatriating 100% forex proceeds abroad.

16. CBN orders banks to stop cash payments for BTA, PTA.

17. CBN increases limit for import, export price verification to 15% from 2.5%.

18. CBN orders banks to stop spending naira revaluation gains.

19. CBN directs all inbound money transfers to Nigeria to be paid only in naira through a bank account at the prevailing rate in the forex market.

20. The office of the National Security Adviser (NSA), led by Nuhu Ribadu, is collaborating with the Central Bank of Nigeria (CBN), and law enforcement agencies such as the Nigeria Police Force (NPF), the Economic and Financial Crimes Commission (EFCC), the Nigeria Customs Service (NCS), and the Nigeria Financial Intelligence Unit (NFIU) in a joint effort to combat forex speculation and tackle the issues affecting the country’s economic stability.

21. CBN issued revised BDCs regulatory framework mandating foreign exchange sellers to BDC of the equivalent of $10,000 and above to declare their forex sources.

22. CBN placed an annual limit of $10,000 for school fees and $5,000 for medical bills per individual.

23. CBN announced a decision to distribute $20,000 to each eligible BDC operator across the country.

Additionally, the CBN also recently cleared all legitimate forex backlog,among many other interventions.

While the policies may have yielded results, former Vice President Atiku Abubakar, recently criticised President Bola Tinubu’s foreign exchange policy, saying its hurried implementation without careful planning has led to multiple economic crisis in the country.

In a series of posts on his X account, he averred that the government did not allow the Central Bank of Nigeria (CBN) to develop and implement a sound FX management policy that would have dealt with such issues as increasing liquidity, regulating demands as well as rate convergence.

“The Government did not allow the CBN the independence to design and implement a sound FX Management Policy that would have dealt with such issues as increasing liquidity, curtailing/regulating demand, dealing with FX backlogs and rate convergence.

“I firmly believe that if and when the Government is ready to open itself to sound counsels, as well as control internal bleedings occasioned by corruption and poorly negotiated foreign loans, the Nigerian economy would begin to find a footing again.”

Furthermore, the former vice president offered some possible solutions that can address the burgeoning foreign exchange crisis in the country.

According to him, the government can implement a managed-float policy rather than a free-float FX regime.

He further stated that the government needs to bolster its foreign exchange reserve to promote liquidity in the market.

“Nigeria’s major challenge is the persistent FX illiquidity occasioned by limited foreign exchange inflows to the country. Without sufficient FX reserves, confidence in the Nigerian economy will remain low, and Naira will remain under pressure. The economy will have no firepower to support its currency.

“On the other hand, given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill. We would have encouraged the Central Bank of Nigeria to adopt a gradualist approach to FX management. A managed-floating system would have been a preferred option.

“In simple terms, in such a system, the Naira may fluctuate daily, but the CBN will step in to control and stabilise its value. Such control will be exercised judiciously and responsibly, especially to curve speculative activities,” Atiku stated.