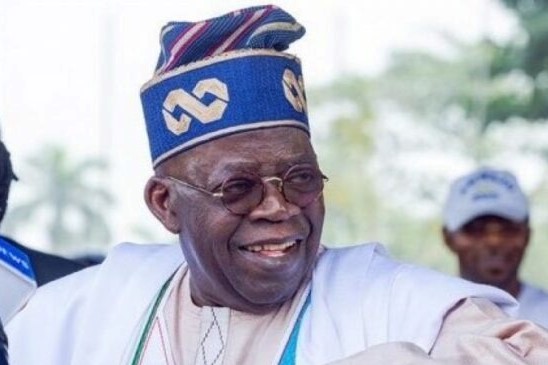

Stakeholders in Insurance and Pension industries on Sunday outlined their expections in the sectors to the incoming President, Sen. Bola Tinubu, to boost their contributions to national development.

They made their expectations known in separate interviews with the News Agency of Nigeria (NAN) in Lagos.

They also expressed optimism that the sectors would contribute significantly to the economy if the new government yielded to their demands.

Mrs Yetunde Ilori, Director-General, Nigerian Insurers Association (NIA), said the insurance industry expects to engage the new leadership, while calling for a national policy on various classes of insurance.

The director-general said the insurers expect the new government to help them to enforce compliance with compulsory insurances where need be.

“Not all the enforcement are under our supervisory authority. So, we need the help of the government in collaboration with other agencies,” she said.

According to her, the insurance sector has been supportive to the government, especially during the COVID-19 outbreak.

She, therefore, urged the government to ensure all policies needed to assist the sector.

Ilori charged the new government to ensure prompt payments of premium, while assuring that the insurers would not renege to pay claims in return.

In his contribution, Dr Muda Yusuf, Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), charged the Tinubu led-government to support the Insurance and Pension industries to grow, especially with right policies.

Yusuf noted that at present, the level of penetration of both industries, compared to their counterparts within the continent and globally was relatively low.

He noted that there was need for effective regulations that would significantly increase the level of corporate governance within the industries.

“Although, the operators have their issues and challenges to tackle, to improve the level of penetration and investment. We need enforcement with respect to compulsory insurance.

“The government has a whole lot of assets. If there was proper compliance with all the compulsory insurance regulations, the level of premium recorded presently would be multiples of what we have.

“Unfortunately, there is no enforcement. Government assets, properties, vehicles, buildings, infrastructure and so many others should be insured,” he added.

For the pension industry, Yusuf advised the new leadership of the country to work towards broadening the industry’s scope of coverage by deepening penetration of the micro pension.

He expressed worry that the scope of coverage of the pension industry was still limited to the formal sector, noting that it still needed to be expanded.

“Although, something is being done through the micro pension. We need to expand the scope because the penetration of that segment is still very low.

“The incoming government must do a whole lot of work to create awareness and deepen penetration outside the formal sector of the economy.

“Deepening of the micro pension would go a long way to further increase the pension assets,” he said.

Also, Mr Ivor Takor, Director, Centre for Pension Right Advocacy, charged the new government to ensure prompt payment of the outstanding accrued right.

Takor said that had been causing delay in the payment of pension benefits.

Takor also said the Tinubu-led government should look into increasing pension for workers under the Contributory Pension Scheme(CPS), whenever there is a salary increment, as stipulated by the constitution.

He noted that the pensioners needed improved healthcare, due to their deteriorating health conditions as they age.

According to him, the new government can introduce Heath Insurance for retirees throughout their life time.

The Advocate advised the incoming government to strengthen the Residential Mortgage introduced by the National Pension Commission (PenCom), known as Retirement Saving Account (RSAs) for Mortgage, and link it to the National Housing Fund(NHF) for easy and effective accessibility by workers.

According to him, once workers are able to get decent accommodation before their retirement, it makes life easier and more convenient for them after retirement.

He, therefore, called on the new government to work towards achieving this.