The Central Bank of Nigeria on Thursday revealed a programme that seeks to repatriate $200 billion exclusively from non-oil exports over the next three to five years.

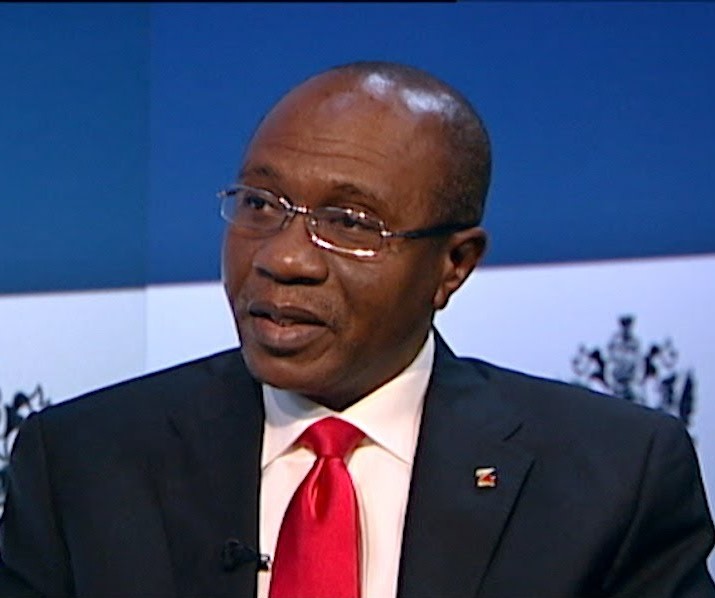

This was disclosed by the CBN Governor Godwin Emefiele while briefing on the outcome of the Banker’s Committee meeting in Abuja.

He said the RT200 FX Programme targets increased exports, value addition and improved foreign exchange for the government.

Another segment of the plan includes a non-oil rebate scheme, a central warehousing scheme as well as a concessionary and long term funding for non-oil exporters.

Emefiele said, “After careful consideration of the available options and wide consultation with the Banking Community, the CBN is, effective immediately, announcing the Bankers’ Committee ‘RT200 FX Programme’, which stands for the ‘Race to US$200 billion in FX Repatriation,’” Mr Emefiele said.

“The RT200 FX Programme is a set of policies, plans and programmes for non-oil exports that will enable us attain our lofty yet attainable goal of US$200 billion in FX repatriation, exclusively from non-oil exports, over the next 3-5 years.”

Mr Emefiele noted that while the goal itself may appear unattainable to some, he was resolute that it could be achieved.

“Many countries that are much less endowed than Nigeria are doing it,” the governor said.

“Consider for example that agriculture exports alone from the Netherlands was about US$120 billion last year. Yet, the Netherlands has a land mass of about 42,000 square kilometers, which is much smaller than the land mass of Niger State alone, at over 76,000 square kilometers.”

Emefiele said the programme is not intended to be a silver bullet to all the nation’s problems in the export sector.

“Rather it is a first step meant to ensure that the CBN is able to carry out its mandate in an effective and efficient manner, which guarantees preservation of our scarce commonwealth, and the stability of our national currency, the Naira,” he said.

“It is only by boosting the productive and earning capacity of this economy that we can truly preserve the long-term value of our currency, as well as the stability of our exchange rate.”