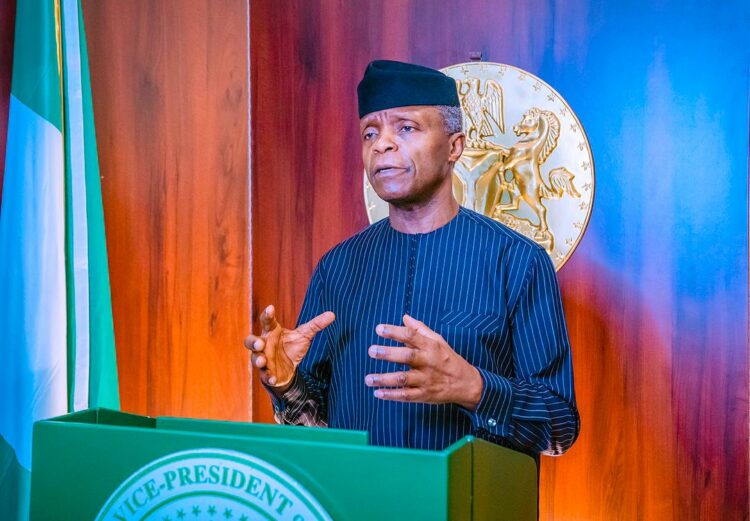

Vice president Yemi Osinbajo has stated that Nigeria’s refusal to sign the Organisation for Economic Cooperation and Development (OECD) corporate tax treaty was because it will lead to more revenue leakages in the system.

He stated this in his address at the 24th Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN), themed, “Global Disruption and Digitisation: Implications for Socio-Economic Development.”

In October 2021, Nigeria had rejected the tax agreement signed by 136 countries, to enforce a corporate tax rate of at least 15 per cent. This was in spite the position of experts experts that the country would benefit more by signing the agreement.

The countries agreed to the pact amid concerns that multinational companies were re-routing their profits through low tax jurisdictions to cut their bills. The measures were also part of efforts to take advantage of the emerging digital economy.

However, Osinbajo who said the treaty would further “compound the issue of leakages in our tax system,” lamented that Nigeria was confronted with unprecedented leakages in tax administration, a situation that had threatened fiscal stability in all the tiers of government.

According to Osinbajo, who was represented by the Executive Chairman, Federal Inland Revenue Service (FIRS), Mr. Muhammad Nami, the revenue leakage is not unconnected with corruption in the tax system.

“We didn’t sign not because we wanted to do it in our own way but one, you have a requirement that for you to be able to tax any digital player or any multinational enterprises globally, that company of enterprise must have annual turnover of $20 billion. That was the first concern.

“The second concern is the averaging mechanism. This $20 billion turnover is not just for the accounting year but for an average of three years. So that enterprise must make $20 billion for three consecutive years otherwise that enterprise would never pay in any country it operates in except to the country of origin,” he explained.

The vice president further said Nigeria was also concerned with the requirement that 20 per cent of the $20 billion must be generated in a country like Nigeria else, whatever business that enterprise does in Nigeria, we cannot subject it to any tax in Nigeria.

“Above all, we should not forget our tax law. The minimum turnover you require as a business in Nigeria to be able to register with the FIRS and pay taxes in Nigeria today is just N25 million. And for somebody that makes less than 10 per cent of $20 billion which I believe is about $2 billion in Nigeria and that person will not pay tax in Nigeria.

“I think that injustice is unimaginable, it is wrong and we will stand firm and say we will not accept it, and that’s why we rejected signing the agreement.

“If a company operating in Enugu generated only N25 million ($60,000) is going to open an office in Nigeria, pay for utilities, employ staff , and still pay tax to Nigeria; but somebody who generates maybe $1 billion should walk away with the gross revenue without paying tax to this country, we feel that should not be done,” he added.

Osinbajo, however, noted that issues of insecurity and criminality, inadequate social economic infrastructure among others, could only be addressed if there’s adequate revenue in the hands of government through effective taxation and compliance.