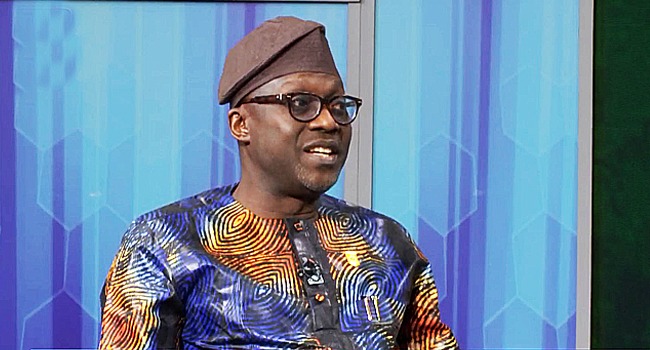

Director-general of the Manufacturers Association of Nigeria (MAN), Segun Ajayi-Kadir, has made a case for targeted tax waiver incentives for the manufacturing sector to support its growth and complement government’s ease of doing business efforts.

He made the call at a webinar organised by the Manufacturers Association of Nigeria (MAN) and KPMG on Tuesday, with the theme “Catalysing Growth in a Turbulent Economic Environment: The Role of Tax Incentives.”

He said the incentives should be sector-wide and implemented in a transparent and sustainable manner, devoid of sudden disruptions and indiscretions.

Ajayi-Kadir pointed out that the challenges confronting the manufacturing sector in the face of mounting macroeconomic dynamics were accentuated by the prevailing heightened foreign exchange volatility and high electricity tariff.

He decried the multiplicity and high rate of taxes and levies by the three tiers of government and their agencies, adding that these and other external factors create a challenging business environment for manufacturers in Nigeria.

He, however, said that there was the need to explore all avenues to remain in business, surmount the hurdles and contribute to the much-desired growth in our economy.

He also urged manufacturers to support the implementation of the outcomes and recommendations of the Presidential Committee on Fiscal Policy and Tax Reforms.

Head, Tax, Regulatory and People Service, KPMG West Africa, Elizabeth Olaghere, advised the government to implement policies that can stimulate the economy, particularly in the manufacturing sector, for Nigeria to achieve economic growth.

She urged stakeholders to contribute suggestions to drive the Pioneer Status Initiative (PSI), an income tax relief instrument in Nigeria.

Deputy Director, Tax Policy Advisory, Federal Inland Revenue Service (FIRS), Mr Matthew Osanekwu, said the government had not only provided several incentives, but was determined to ensure that businesses access the incentives.