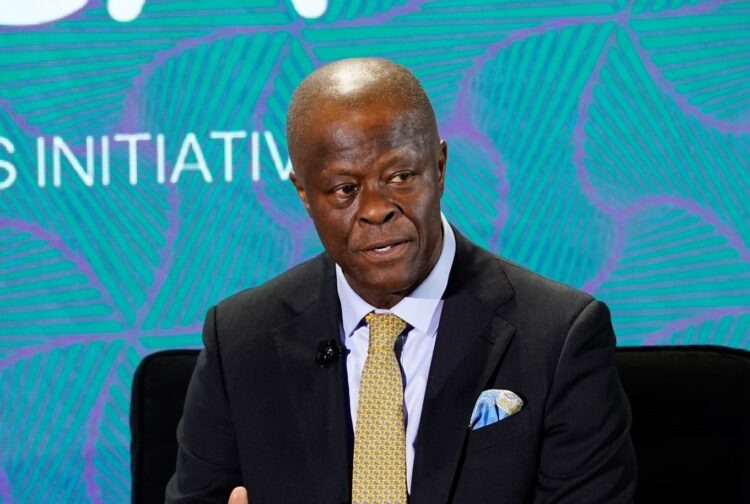

Minister of finance, Wale Edun, has said the Central Bank of Nigeria (CBN) is taking proactive measures to adjust the monetary policy rate (MPR) in order to tackle inflation “head-on”.

He said the efforts are starting to yield the desired results.

Edun stated this while speaking on key economic performance highlights for the first half of 2024 at the ministerial press briefing in Abuja, on Thursday.

He also said the gap between inflation and interest rates is closing, which, according to him, strengthens the naira’s viability and aligns with the president’s economic policies.

“Foreign direct investment is inching up, portfolio investment has risen substantially compared to the same period last year.

“Internal reforms are positively impacting external accounts. The trading position is improving, both the balance of trade and the current account balance are positive as you can see from the charts when you compare Q1 2023 to Q1 2024 figures.

“The reforms have put the economy in a more favourable position globally and these are the building blocks.

“Our government revenue to gross domestic product (GDP) and government expenditure to GDP is low compared to our neighbours at around 14-15 percent and the target is to increase that to around 25 percent.

“The critical nature of our revenue effort cannot be overestimated. We are pleased that the efforts so far are gaining traction,” Edun added.