The Manufacturers Association of Nigeria (MAN) has said one of the effects of the 14 per cent tariff on Nigerian imports by the government of the United States of America is that Nigerian goods will lose their competitiveness in the US market.

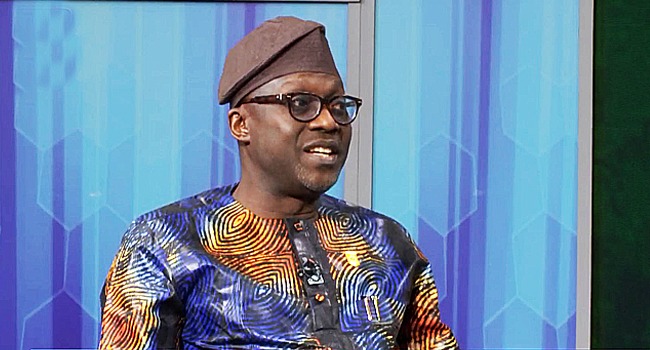

MAN director-general, Segun Ajayi-Kadir, said in a statement that the tariff hike comes at a vulnerable time for Nigeria when the country is just recovering from the impact of the government’s policy mix that has had negative effects on the manufacturing sector.

While pointing out that the US remains a key trade partner for Nigeria, accounting for around seven per cent of the country’s non-oil exports, he added that the new tariff policy posed a direct risk to Nigeria’s trade relationship with the US, especially particularly at a time when the country is implementing an ambitious N55 trillion budget and faced with declining global crude oil prices.

The statement read in part: “Nigeria’s manufacturing sector, which contributed 8.64 percent to the country’s Gross Domestic Product (GDP) in 2024, is one of the most predisposed sectors of the economy when it comes to trade policy shifts.

“The imposition of a 14 percent tariff on Nigerian exports significantly undermines the competitiveness of locally manufactured goods in the U.S. market.

“Manufacturers who are exporters in agro-processing, chemicals and pharmaceutical, basic metal, iron and steel, non-metallic mineral products and other light industrial manufacturing rely heavily on the U.S. for market access.

“With increased costs for American buyers due to the tariffs, demand for Nigerian products is expected to decline.”

Continuing, Ajayi-Kadir said beyond the potential loss of revenue, the new tariffs could discourage firms from investing in value-added manufacturing, pointing out that over the last 10 years, manufacturers have deliberately and strategically worked to shift Nigeria’s export focus from raw materials to semi-processed and finished products.

“However, higher market-entry costs because of higher tariff on Nigerian products will reduce the profitability of such investments, making it more attractive for firms to revert to exporting raw materials,” the director-general stated.

He described the development as counterproductive to Nigeria’s industrialisation agenda and one that compromises the long-term goal of achieving export diversification under platforms such as the African Continental Free Trade Agreement (AfCFTA).

Ajayi-Kadir warned that the tariff hike could have severe consequences for employment within the manufacturing sector, as declining export revenues might force many companies to scale down operations or lay off workers in a bid to manage costs.

He added that beyond the manufacturing sector, the Nigerian economy is not immune from the effects of the tariff decision with its direct impact on Nigeria’s trade balance.

With Nigeria already dealing with a fragile external sector, the MAN director-general cautioned that a sharp drop in exports to the U.S. could erode the current trade surplus and potentially lead to a trade deficit.

He also expressed concerns over possible pressure on Nigeria to respond by lowering its own tariffs on American goods.

Ajayi-Kadir said although the U.S. might present the move as an effort to promote “fair trade,” the truth is that reducing tariffs on American imports could lead to an influx of subsidised goods in the Nigerian market, ultimately undermining local manufacturers.

“Nigeria has, in recent years, made commendable strides toward achieving self-sufficiency in several manufacturing segments and diversifying away from oil,” Ajayi-Kadir said.

“However, succumbing to external pressures to liberalise trade prematurely would reverse these gains. Furthermore, the absence of institutional capacity to engage in sophisticated trade negotiations places Nigeria in a vulnerable position.

“While countries with advanced legal and economic institutions may be able to negotiate favourable terms, Nigeria is at a disadvantage due to capacity constraints,” he added.